WELCOME

Welcome to the Atelier Wealth Premier SMSF Service, designed and maintained specifically for clients of Atelier Wealth Mortgage Brokers by SMSF Alliance. My name is David Busoli and I’m the Principal of SMSF Alliance (dbusoli@smsfalliance.com.au, 0499 778 584) and I’m here to guide you during the establishment process.

ABOUT SMSF ALLIANCE

We are specialist SMSF administrators. Personally, I’m one of the sectors most experienced practitioners. Our management team comprising myself, Debbie Thomas LLB (Head of Technical) and Emma Walker (General Manager) are all SMSF Association accredited SMSF Specialists. Our firm offers SMSF establishment and administration services to accountants and SMSF advisers nationally and, via our alliance with Atelier Wealth Management, to you. We are able to guide and direct you to relevant resources but, as we are not licensed financial advisers, we cannot give you strategy or investment advice. We are SMSF specialists. In this capacity we assist numerous licensed financial planners with SMSF strategy guidance however, due to the advice regulations, we cannot provide the same assistance to you directly. What we can do is answer your questions and provide you with useful tools including document creation, pension and contribution applications, mail house services, access to daily fund reporting and use of our secure communications and reporting portals. If you have a financial planner, we can work with them to further maximise your position.

What Needs to Happen Now?

There’s a lot on information, with links, on this page and the SMSF FAQs on the Atelier wealth site. You should consider this information carefully. If I can help you with any SMSF related questions, please contact me. If you decide to proceed then I will assist to make your experience as smooth as possible. Once your application has been successfully submitted other team members will become increasingly involved until the loan settles. During this time, assuming that we will be providing ongoing tax and administration services to your SMSF, I will introduce you to our secure online communication and reporting portal. At this time, primary responsibility for your SMSF service will pass to one of our experienced accountants backed by our national team. Our aim is to ensure that you are comfortable with your SMSF experience so don’t hesitate to reach out if you have any questions or concerns.

ABOUT SMSFs

Before setting up your SMSF you should be aware of what running an SMSF entails. We recommend you consider the excellent SMSF FAQs on the Atelier Wealth site. In addition, the ATO provides a course for SMSF trustees. It’s 44 minutes long and is time well spent. It will give you an understanding of SMSFs and whether one is right for you. If you decide to establish an SMSF you may rollover all, or part, of your existing superannuation held in an APRA regulated, industry or retail fund so you may also find our video, SMSFs V Large APRA Regulated Super Funds, helpful. Note that you should not wait until you find a suitable property before you start the SMSF establishment process. If you intend to proceed you should do so now as Tax office delays can prevent your fund from being operational for up to two months and rollovers from other superannuation funds cannot commence until then.

Things you need to investigate before deciding on an SMSF.

- Rolling over superannuation monies from your existing fund may have implications on the life, TPD and income protection cover you may hold within it. This should be investigated prior to any rollovers. Note that, should you lose this cover, it is possible that you may not be able to arrange new cover or, if you can, it may be on different terms and/or more expensive. If you do not have a financial adviser to assist, we can assist with an introduction.

- Ensure you have at least a pre-approval for the loan amount.

- If you have made personal concessional contributions that you wish to claim in your personal tax return, you will need to provide a S290-170 Notice of Intent to Claim to your current super fund before rolling over your account. If you don’t, you will lose your ability to claim the tax deduction.

- There are restrictions on who can be a trustee of an SMSF. You might like to watch our video Do You Qualify for an SMSF? just to be comfortable that you, and any other potential members, won’t have issues with the ATO’s approval process.

ABOUT PROPERTY & SMSFs

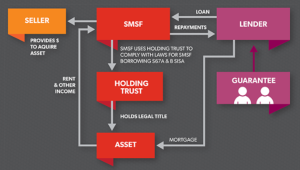

If your intention is for your SMSF to acquire real estate using a loan, there are special rules that make this type of loan arrangement different to borrowings outside of SMSFs. You might like to investigate the ATO’s comprehensive information about SMSF borrowing, otherwise known as Limited Recourse Borrowings or LRBAs. An important feature of such a borrowing is that your SMSF can’t buy the property directly. It can only do so via a holding or bare trust. If your fund is going to borrow to buy a property you should familiarise yourself with this

Other important features of this type of borrowing are:

- you may not increase the amount borrowed or drawdown an amount that has previously been repaid.

- you may not access the equity in an existing property to support a new borrowing on an additional property.

- you can repair or improve the asset, but not with increased borrowings

- you cannot change the fundamental nature of the asset such as by buying a vacant block and later building on it unless the loan is paid out AND the property title is transferred to the SMSF directly. You can, for example, add an extra bedroom to a house but can’t change the use of the building to an office.

Related Party Dealings

Special rules apply if an SMSF is acquiring property from a related party. The definition of related parties is broad and includes you, your spouse, children, parents and companies or trusts that you, or a related party controls. If you have any doubts we can assist. Importantly, an SMSF cannot acquire a residential property, including a residential investment property, from a related party. An SMSF can, however, acquire a commercial property from a related party. Similarly, it is not generally possible for a related party to lease a residential property from an SMSF though commercial property can be occupied under a written lease, at market value rent, paid on commercial terms. A valuation from a registered valuer will be required to support the both acquisition price and rental amount. Note that, if real estate is being acquired from a related party, stamp duty and capital gains tax will apply as the change of ownership is treated as a sale.

An important consideration is the need for the vendor to obtain a clearance certificate to be provided to the SMSF at, or before, settlement. In practical terms, the clearance certificate will usually be provided to the conveyancing lawyer as part of their required settlement documentation. Failure to do so will mean that the SMSF will need to withhold, and remit to the ATO, 15% of the purchase price of the property. The vendor may not be able to recoup this from the ATO until they have lodged their tax return. This measure was designed to prevent tax avoidance by non-resident investors and includes all property dealings, not just those involving SMSFs. There is no exemption for a related party transaction so, to avoid any potential cash flow difficulties, this certificate should be applied for as soon as possible as it could take up to 28 days to issue.

If you wish to establish an SMSF, we can process your request and liaise with the ATO on your behalf. You need to be aware, however, that the ATO may contact you directly, before they approve your application. We have provided two videos that explains the important elements of this contact. Applying for an SMSF – Don’t Ignore the ATO and Applying for an SMSF – What the ATO might ask you.

FEES

There are costs involved in both the establishment and ongoing administration of an SMSF. What follows is an outline of estimated fees. Note that GST is included where applicable.

Setup Fees

To establish an SMSF with a corporate trustee structure, the cost is $2,200 (including ASIC fees). Our establishment service includes company establishment & ASIC registration, associated establishment documents, SMSF trust deed, bank account establishment (optional) and liaising with the ATO for the issuance of the SMSF’s ABN, TFN and approval. We will also assist with the rollover from your current superannuation provider if we are administering your SMSF after establishment. Note that the continuation or replacement of any existing life insurance is your responsibility as previously mentioned.

To establish a limited recourse borrowing an SMSF is required to have an additional Bare Trust with an additional company as trustees. The cost for this is $1,500 (including ASIC registration fees).

So, the total cost for the establishment of the SMSF and Bare Trust is $3,700. Payment will be required at the time of submitting your order by credit card. Processing will commence once payment has been received.

Ongoing Fees

Our annual SMSF administration service fee for a fund with a singly property is $2,683 ($2,184 is paid by monthly direct debit of $182 from the SMSF’s cash account. The balance is debited at different times as per the table below.) We prepare the fund’s financials and lodgement of its annual tax return, facilitate its annual audit, and act as the ASIC agent and registered office for both of the trustee companies. Our ongoing service includes supporting fund compliance, document creation, pension and contribution tools, mail house services, access to daily fund reporting and use of our secure communications portal. You will have a dedicated fund accountant and access to our technical team should you have questions.

Your SMSF will also incur yearly third-party costs which may vary. Currently the ATO levy fee is $259 per annum, though the ATO require that the second year’s fees be paid in advance. The yearly independent audit fee is $565. ASIC currently charges $65 per year for the SMSF Corporate Trustee, and $310 for the Bare Trust Corporate Trustee.

Your fund’s estimated total ongoing costs per year, and when they are charged, is

| Item | Annual Estimate | Notes |

| Ongoing Administration | $2,184 | $182/mth incurred from start date so first year charge will be for the part period only. |

| Single Property Inclusion | $257 | Payable when end of year accounts are prepared |

| Corporate Trustee ASIC Agent & Registered Office x 2 | $242 | Payable on the anniversary of company establishment |

| Independent Annual Audit | $565 | Payable when end of year accounts are prepared |

| ASIC Annual Fee | $375 | Payable on the anniversary of company establishment |

| ATO Annual Fee | $259 | Payable when financials are lodged. 2 years is payable in the first year |

| Total | $3,882 |

Your SMSF will need a cash account to receive all contributions and investment income and pay all expenses, including those mentioned above, which will be debited from your SMSF’s cash account under a debit authority. We can assist you to set up the cash account using Macquarie Bank’s cash management product. We do not receive any commission or inducements from Macquarie Bank. We favour them as they provide maximum flexibility which allows us to make payments to the ATO and ASIC on your behalf. You are under no obligation to use this bank and can choose an alternative if you wish. Note that, even with a Macquarie Bank account, we will not make any general expense payments (insurance, rates, etc) on your fund’s behalf. These are your responsibility as trustees.

THE PROCESS

Overview

To establish a new SMSF to acquire a property using borrowing will require;

- A corporation to act as trustee for the SMSF

- An SMSF deed

- ATO approval of the SMSF establishment

- A corporation to act as trustee of the bare trust

- A bare trust deed

If you already have an SMSF, the process will differ a little. If the SMSF already has a corporate trustee, then you may still proceed using the online form below. If it has individual trustees, you will need to speak with us about changing trustees as this will be a requirement of the lender.

The process is in two parts.

Initial Application for Establishing the SMSF, SMSF Corporate Trustee and Bare Trust Corporate Trustee

The application is available here. Please be aware that you will be asked for the following so it will be useful if you gather this information before proceeding.

Fund Details

- Proposed name – please do not begin the name with “The”. Is the fund to be registered for GST (generally no)?

Member/Director Details

- Full names including middle names and any prior names, Date of Birth, Town & Country of birth, Street Address, Mobile number, Email, Director Identification Number (DIN), Tax File Number (TFN), Specific occupation, Copy of driver’s licence or passport to be uploaded with the application.

Trustee Company Details

- If a company already exists: Company Name, A.C.N, Registered Address, list of directors

- To establish a new company: 3 company name preferences, who are the shareholders and number of shares, who is company secretary and/or public officer (can be all)

On submission you will receive a confirmation containing a reference number. If SMSF Alliance is to be appointed tax agent for your SMSF then you, and the other trustees, will receive an SMS from VerifyID (containing this reference number to prove its validity) which you will need to action within 48 hours. This is a government requirement.

We will prepare the documentation and post the documents to you by express post. They will need to be signed where marked, and returned to us, in full, in the express post envelope provided. If we are administering your fund your secure portal and other items will be activated at this time.

We will advise you once your SMSF is operational. If we are administering your SMSF, you will be allocated a senior accountant to be your main contact point, and the process of rolling over balances from other funds can commence. Note that we can only assist with the rollover process if we are administering your SMSF.

The SMSF will now be able to purchase the property in the name of the trustee of the bare trust. Note that, though we have not printed the deed for the bare trust it is still valid as a verbal trust. Once the contract has been signed you can complete the second application form.

Final (Second) Application for Finalisation of the Bare Trust Deed and Settlement

The final application form is available here. It requires a copy of the contract to be attached. This will enable us to finalise the bare trust document using the correct details and enable our Head of Technical, Debbie Thomas, to liaise with your lawyers, if required, to help facilitate the settlement process.

How to Proceed

Once you have decided to proceed you can complete the Initial Application.

I’m happy to assist if you need me.

We look forward to being of assistance.

Regards

David Busoli

Principal of SMSF Alliance

dbusoli@smsfalliance.com.au

0499 778 584